What is an auto damage appraiser’s salary? This is likely the first question you’ll have when considering becoming an auto damage appraiser.

The answer varies greatly depending on whether you are a staff appraiser or an independent auto damage appraiser and where you live in the country.

In this article, I’ll cover both an independent and a staff auto damage appraiser’s salary and pay.

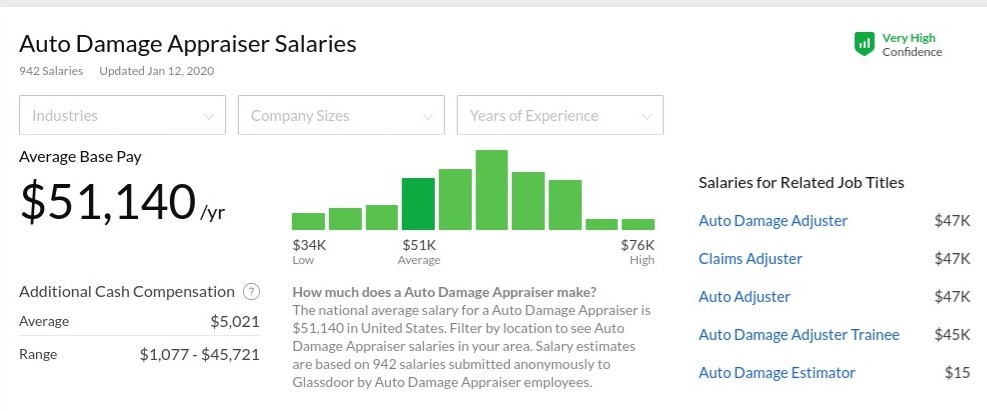

Average salary for an auto damage appraiser

The average salary of an auto damage appraiser is just over $50,000 a year. This is looking at all the different levels of auto damage appraisers combined.

The newest and least experienced auto damage appraiser salary is closer to $34,000 per year, and the veteran auto damage appraiser’s salary can reach up to $76,000 per year.

Location can also greatly affect your salary. An auto damage appraiser salary in Massachusetts will not be the same as in North Carolina. New York and California will have different salary ranges from Alabama.

Your experience level and the company you are working for also have a big impact on your salary. Let’s look at some examples of how it can be higher or lower, based on specific job openings at the time of this writing.

Geico Auto Damage Appraiser Salary

The average auto damage appraiser salary at Geico is $51,362, according to their current job listings.

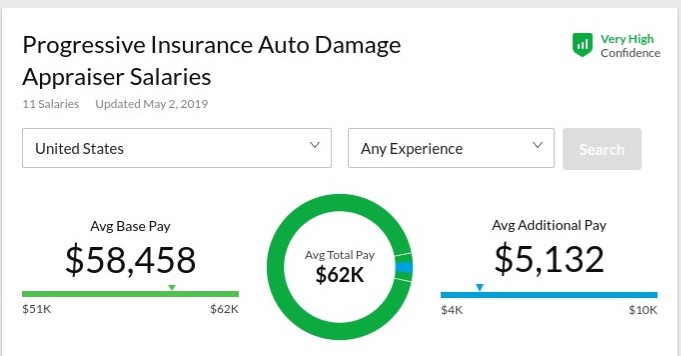

Progressive Auto Damage Appraiser Salary

The average auto damage appraiser salary at Progressive is $58,458 per year.

USAA Auto Damage Appraiser

The average auto damage appraiser salary at USAA Insurance is $71,587.

Liberty Mutual Field Auto Damage Appraiser Job Opening

Liberty Mutual is offering an auto damage appraiser salary of $60,700 – $82,700 in Connecticut, but in South Carolina, the salary scale is $53,200 – $73,100.

Liberty Mutual is offering an auto damage appraiser salary of $60,700 – $82,700 in Connecticut, but in South Carolina, the salary scale is $53,200 – $73,100.

The difference in salary is likely due to a difference in the cost of living between these areas. Where an auto damage appraiser falls on that scale will depend on experience and qualifications.

Independent Auto Damage Appraiser Salary

The key to an independent auto damage appraiser salary is YOU, the appraiser. If you are operating as an independent auto damage appraiser, you are a business owner, a freelancer. That is why you are called an “independent.”

Independent auto damage appraisers don’t have a salary — they get paid based on how many claims they process.

In my experience, most full-time independent auto damage appraisers earn on the higher end of what a staff adjuster makes, between $60,000 – $80,000 a year once their business is established.

But there is more to consider than salary — being independent means you have a lot more freedom.

Is it worth it to become an auto damage appraiser?

I’ve been an independent auto damage appraiser for eleven years. In my first year, I earned $42,000 as a dumb kid who had no clue about how the industry worked, and I’ve made well past six figures in other years.

My auto damage appraiser salary averaged out to $80,000 if I worked full time, year-round. But the greatest part about being an independent auto damage appraiser, is you don’t have to work year-round. That is what I love about being an independent auto damage appraiser.

As an independent, you are a business owner, and you are in control of your earnings and your life. All you have to do is claim it.

I’ve handled claims locally where I live and traveled the country, working catastrophic claims as an independent auto damage appraiser and adjuster. Living part of the year on a sailboat with my wife and kids, and then returning a few months later to resume my business.

Is being an auto damage appraiser worth it? YES, if you know the life that you want.

I have met and known many staff auto damage appraisers, and they are typically happy with their job. But the independents that I know are in love with the freedom that they enjoy by owning their own business.

Ready to claim your life?

How do auto damage appraisers get paid?

Staff auto damage appraisers work for insurance companies as w-2 employees. They receive a check like clockwork based on the salary divided by the number of pay periods.

Independent auto damage appraisers are paid per claim by independent adjusting and appraisal firms. The pay per claim ranges from $50-$100 depending on your experience and client.

Some independent appraisers handle photo only auto damage inspections, handling only a small part of the job, for $20 – $40 per claim.

These rates have not increased in recent years, causing some to leave the industry. However, advances in technology have made the job easier than ever. That means you can process more claims in less time, and independent auto appraisers are still thriving.

Being independent means you have to be willing to treat your work like a business and manage cash flow around when your clients pay. For independent auto damage appraisers, the pay is usually delayed 2 – 6 weeks. Most clients pay you for the previous month’s work on the 15th of the following month.

Getting started as an appraiser

If you want to become a staff auto damage appraiser at an insurance company, be aware most require a college degree. Experience helps but is not required. Head over to Indeed or Zip Recruiter to find jobs in your area for insurance companies.

If you want to become an independent auto damage appraiser, check out my Amazon best selling book, the Independent Adjuster’s Playbook.

The Independent Adjuster’s Playbook walks you through every step of becoming an auto damage appraiser. It is your step by step guide to becoming a successful independent appraiser or adjuster.

FAQ

Auto damage appraiser job outlook

Many people fear that technology will remove auto damage appraisers and adjusters from the workflow. Although the technology is rapidly changing, it is no more in danger of removing people from it than any other industry.

Insurance at its core is a people business and it will be harder to replace people completely with technology than in most industries.

What does an auto damage appraiser do?

- Set Appointments with an Owner of a Vehicle

- Drive to the Owner’s Location

- Inspect the Damaged Vehicle

- Document Damage with Photos (get the Guidelines for Required Photos HERE)

- Document Damage with Notes

- Create an Industry Standard Estimate using Audatex, CCC One, or Mitchell Software

- Upload Estimate, Photos, Notes, and Estimate Data to Company Portal

- Complete Any Revisions or Supplements* that May Arise

*Supplements are a request from a repair facility for supplemental or additional repair operations and parts that were not included on the first estimate.

How do you become an auto appraiser?

For staff adjusters, you must have a college degree and contact an insurance company to start the hiring process.

Independent auto damage appraisers need to determine if they are required to have a license in their state to perform appraisals.

You can also check out my training for auto damage appraisers to learn more.

How much money do auto insurance adjusters make?

The average amount an auto adjuster makes is $54,128. If you include other related jobs and fields the average comes out to around $62,000.

What is the difference between an appraiser and an adjuster?

An auto damage appraiser focuses more on the value of the damage and value of the vehicle while the adjuster is handling the settlement of the claim. Some adjusters do also complete auto damage appraisals and estimates, but not always.

Also, different licenses are required for adjusters and appraisers, depending on the state in which you intend to work.

How much does an auto appraisal cost?

Most insurance companies are paying independent auto appraisal firms or TPA’s between $100 – $250 depending on the level of service, tasks needed to complete, and level of involvement.